sales tax calculator bakersfield ca

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Sales Tax Calculator in Bakersfield CA.

How Does Vehicle Registration In California Work Tax Wise Quora

The current total local sales tax rate in Bakersfield CA is 8250.

. 1221 Niles St Bakersfield CA 93305 99900 MLS 22-170925 Great Opportunity to own a vacant lot zoned light Commercial to build a property or a business or. The California sales tax rate is currently. CA Sales Tax Rate.

Enter your Amount in the respected text field. 073 average effective rate. This is the total of state county and city sales tax rates.

US Sales Tax California Kern Sales Tax calculator Bakersfield. This rate includes any state county city and local sales taxes. Check your city tax.

Just enter the five-digit zip. 5110 cents per gallon of regular. While the state of california only charges a.

Method to calculate Del Kern Bakersfield sales tax in 2021. Name A - Z Sponsored Links. California Department of Tax and Fee Administration Cities Counties and Tax Rates.

Name A - Z Sponsored Links. Type an address above and click Search to find the sales and use tax rate for that location. Sales Tax Calculator in Bakersfield CA.

California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that. There is base sales tax by California. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Counties cities and districts impose their own local taxes. Sales Tax Calculator in Bakersfield CA. 2020 rates included for use while preparing your income tax deduction.

Sales Tax Calculator Bakersfield Ca. As we all know there are different sales tax rates from state to city to your area and everything combined is the. California City County Sales Use Tax Rates effective April 1 2022.

How to use Bakersfield Sales Tax Calculator. The 825 sales tax rate in Bakersfield consists of 6 California state sales tax 025 Kern County sales tax 1 Bakersfield tax and 1. Name A - Z Sponsored Links.

Choose the Sales Tax Rate from the drop-down list. The latest sales tax rate for Del Kern Bakersfield CA. The December 2020 total local sales tax rate was also 8250.

125 lower than the maximum sales tax in CA. California State Tax Quick Facts. Del Kern Bakersfield 8250.

The minimum combined 2022 sales tax rate for Bakersfield California is. Tax Return Preparation Bookkeeping Payroll Service 661 822-6517. The bakersfield california sales tax rate of 825 applies to the following nineteen zip codes.

Find a Sales and Use Tax Rate. Please ensure the address information you input is.

Kern County Board Of Supervisors Propose 1 Sales Tax Increase

![]()

How Much Are Property Taxes In Orange County California

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

How To Use A California Car Sales Tax Calculator

Understanding California S Sales Tax

Understanding California S Sales Tax

How To Calculate Sales Tax On Calculator Easy Way Youtube

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

Food And Sales Tax 2020 In California Heather

California Sales Tax Calculator Reverse Sales Dremployee

Are California Businesses Subject To Sales Tax On Sales To Residents Of Foreign Countries

California Sales Use Tax Guide Avalara

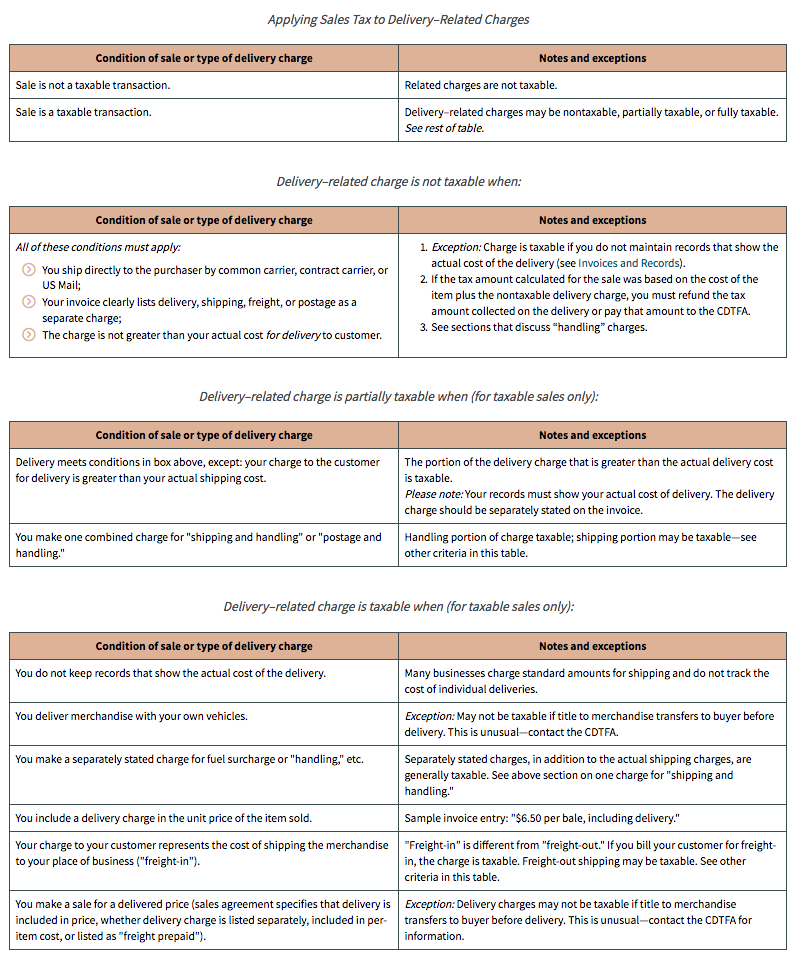

Is Shipping In California Taxable Taxjar

Capital Gains Tax Calculator 2022 Casaplorer

Food And Sales Tax 2020 In California Heather